Many creditors require debtors to divulge whether they own or rent their homes when filling out credit applications, so creditors can refer to this information during their collection efforts. Of course, a judgment lien is only effective if the debtor actually owns real estate in the county where the lien is on file. The judgment lien takes priority over subsequently recorded liens, except tax liens and purchase-money mortgages. The lien is then sent to the register of deeds for recording in the county where the debtor lives. How Judgment Liens WorkĪ judgment creditor can file a lien with the court 22 days after the judgment is entered against the debtor, provided that the debtor has not appealed or moved to set the judgment aside. However, if and when the debtor attempts to sell or refinance the property, he or she will not be able to do so unless the lien is paid and subsequently released. Though the lien operates much like a mortgage on real estate owned by the debtor, a judgment creditor cannot foreclose on this lien and sell the property to satisfy the judgment. The lien is an encumbrance on such property, much like a mortgage, tax lien, or home equity line of credit. What Is a Judgment Lien?Ī Michigan judgment lien is a document filed with a county recorder or registrar of deeds that attaches to real property in that county owned by the debtor identified in the lien. This collection mechanism has only been available in Michigan for a few years, but in the right circumstances, a judgment lien can produce significant results. If you are a judgment creditor in Michigan, you can interfere with a debtor’s ability to engage in such transactions through the use of a judgment lien. Please contact us today to schedule a consultation.If you own real property in Michigan, you won’t be able to sell it or refinance unless you have a clean title. At the Fullman Firm, our knowledgeable judgment lien attorneys will do everything in our power to ensure that your California judgment lien case is a success.

If you’ve had a lien placed on your property in California, you should contact a California attorney for assistance. Act Now to Remove or Settle Your Judgment Lienĭebt collectors sometimes make mistakes when filing lawsuits, and this results in erroneous judgment liens. A California judgment lien removal attorney will help you explore your options and choose the best course of action for your situation.

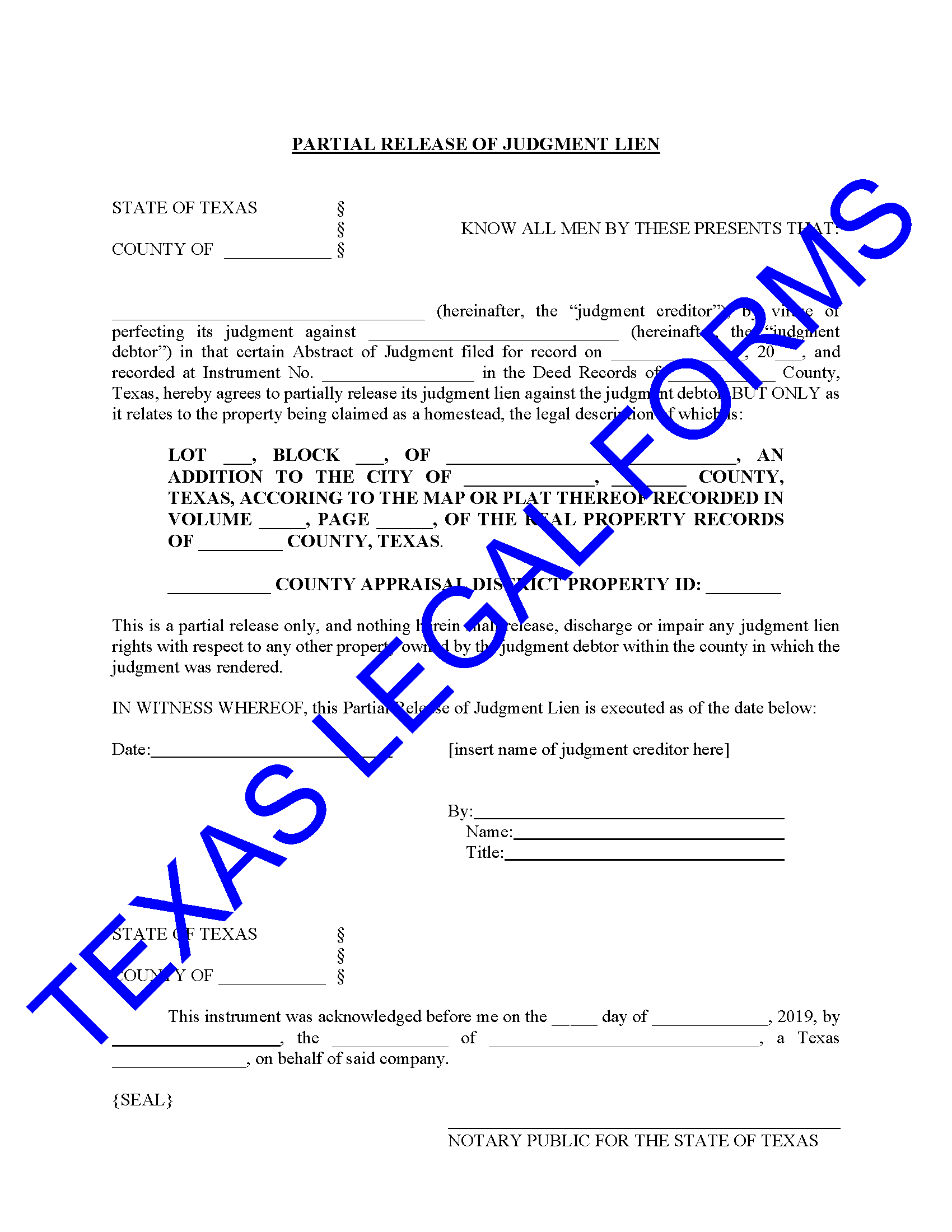

However, regardless of the options that may be available to you in your unique case, the best way to address a judgment lien is with the help of an experienced California attorney. There are several options available to remove a judgment lien from a piece of property, including negotiations, a court order, bankruptcy, and paying off the debt that resulted in the lien. any related bankruptcy or foreclosure proceedings.Īny property owner who has a judgment lien attach to his or her property should take immediate action.a homestead exemption amount if the property is a debtor’s primary residence, and.In California, a creditor’s ability to collect under a judgment lien may be limited by several factors, including This applies even if the property changes hands during this time. In California, a judgment lien remains attached to a debtor’s property for ten years. For personal property, a creditor may either file a notice of judgment lien with the California Secretary of State or serve the debtor with a notice of a debtor’s examination. In order to attach a judgment lien to real estate in California, a creditor may take or mail a court judgment to the county recorder’s office where a debtor owns real estate. In California, a judgment lien can attach to multiple types of property, including real estate (e.g., a house, condo, or other types of property interest) and personal property (e.g., art, jewelry, or antiques). In this article, we discuss the basics of judgment liens in California. A judgment lien gives a creditor the right to receive a certain amount of money from the proceeds of the sale of a debtor’s property. A judgment lien is one method that courts use to ensure that judgments are satisfied. However, the debtor in a case doesn’t always pay as required. As part of a judgment, the court orders one party (the debtor) to pay money to another (the creditor). A judgment may also result from a settlement between parties.

After a judge or jury hands down a verdict in a civil case, the court enters a judgment.

0 kommentar(er)

0 kommentar(er)